Tim McCready breaks down the numbers in EY's investment report.

The annual EY Private Equity & Venture Capital Monitor was released this month, and was characterised by a record level of overall activity of $1.7b in the year to 31 December 2018.

This was an increase of $709.3m from 2017's $989.6m, and significantly above the $870.2m average since the survey began in 2003.

Total investment activity in 2018 was $1.1b, spread across 62 deals. This was up $218m from 2017, driven by a higher average deal value in 2018 ($17.6m) compared to 2017 ($12.9m).

"Private capital is an important aspect of the New Zealand economy, because it represents a larger proportion of the overall capital markets than in other geographies," says Andrew Frankham, chair of the New Zealand Private Capital Association.

"The Monitor illustrates the availability of private capital in New Zealand remains healthy, with renewed interest in early stage investing and continued strong activity in the mid-market investment space."

Mid-market investment activity

Mid-market investment activity remained buoyant in 2018, resulting in $245.0m in investments, though this was down on 2017's record high of $333.7m. Average investment value decreased from $19.6m in 2017 to $12.9m in 2018, a return to the longer-term average trend.

Mid-market transactions in 2018 included investments by New Zealand domiciled funds including Direct Capital, Maui Capital, Milford Private Equity, Pencarrow Private Equity, Pioneer Capital, Oriens Capital and Waterman Capital. There was also an increased level of activity from funds outside Oceania.

Divestments in the mid-market showed an increase from 2017, primarily driven by transactions of Australian funds. "The sector continues to be a strong performer with more than $1.9 billion invested in the past decade and $976 million returned to investors to date," says Frankham.

Standout sectors

Rocket Lab ensured technology remained the dominant sector for VC in 2018. Other sectors obtaining investment in 2018 included food/ beverage, and health/biosciences.

Respondents to the Monitor's survey were asked to identify which sectors they were most optimistic and pessimistic about. Food/beverage (31 per cent) and health/biosciences (25 per cent) both continue to generate significant optimism. The standout sector causing pessimism was media/communications (46 per cent).

Outlook

The Monitor showed a slightly more positive view of the next six months compared to last year.

Respondents were largely optimistic. This reflects the economy's relative resilience compared to global markets. Over the next 18 months, the outlook is still slightly improved from last year.

"Investment in New Zealand's private companies continues to provide excellent opportunities for experienced managers to accelerate growth and generate value for investors," says Frankham. "A number of local institutional investors continue to consider increasing mandates targeting private equity."

Fund managers were asked to highlight key factors they consider will impact their activity in New Zealand over the next 12 months.

● Venture capital respondents noted: achieving successful exits, availability of capital, and the potential impact of Government policy.

● Private equity respondents noted: level of "dry powder" and competition for assets driving higher multiples, ability to hire skilled and experienced employees, potential impact of tax changes on investor participation, and increased opportunities from ageing vendors seeking succession.

Colin McKinnon, executive director of the New Zealand Private Capital Association says:

"The mid-market and the angel network are demonstrating consistent and healthy deepening of the private capital market. The emerging prospects for additional formal venture funds are pleasing.

International investor interest in New Zealand companies across all stages continues to provide New Zealand's private markets with opportunities to grow quality companies and management teams.

"Private capital assists in accelerating growth ambitions of New Zealand businesses. Growing businesses with capital and expertise improves productivity, which is good for New Zealand."

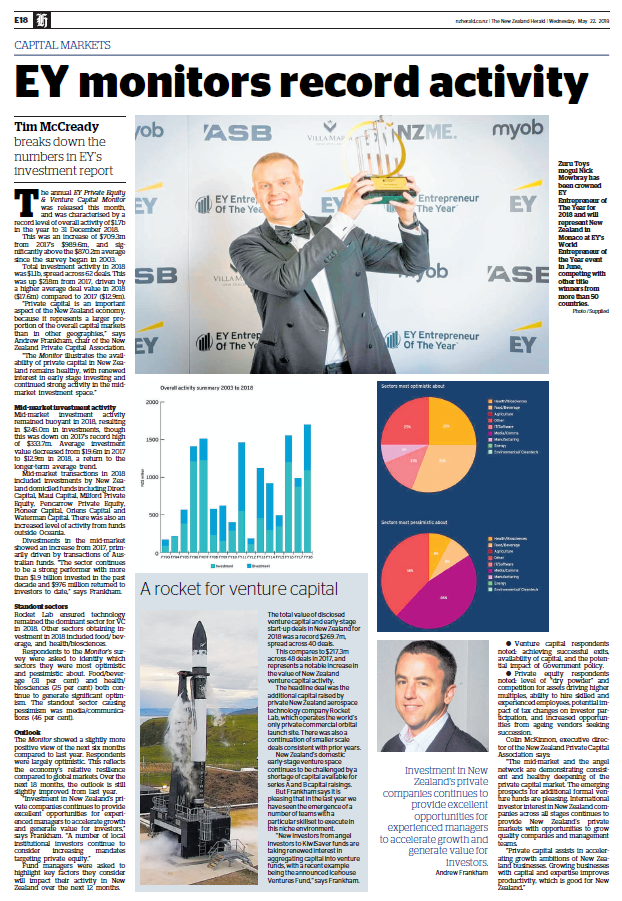

A rocket for venture capital

The total value of disclosed venture capital and early-stage start-up deals in New Zealand for 2018 was a record $269.7m, spread across 40 deals.

This compares to $217.3m across 48 deals in 2017, and represents a notable increase in the value of New Zealand venture capital activity.

The headline deal was the additional capital raised by private New Zealand aerospace technology company Rocket Lab, which operates the world's only private commercial orbital launch site. There was also a continuation of smaller scale deals consistent with prior years. New Zealand's domestic early-stage venture space continues to be challenged by a shortage of capital available for series A and B capital raisings.

But Frankham says it is pleasing that in the last year we have seen the emergence of a number of teams with a particular skillset to execute in this niche environment.

"New investors from angel investors to KiwiSaver funds are taking renewed interest in aggregating capital into venture funds, with a recent example being the announced Icehouse Ventures Fund," says Frankham.